Artificial intelligence is the investment trend you shouldn't miss

An artificial intelligence (AI) installed on a computer with the name Deep Blue changed the course of history. After a six-round chess contest, Deep Blue computer dethroned world champion Garry Kasparov, from Russia.

The first time that a computer beat a human at a formal chess match. Since the time, computers have become even more proficient at completing complicated tasks. The underlying principle of this lies in artificial intelligence.

AI is among the most popular technology trends today. It's on par with the likes of virtual reality (VR) nanotech, blockchain, robotics, 3D printing, and nanotech. However, AI is more important than these things.

This is because most of these technologies are based on AI or, at the very least, AI underpins their development. However, this AI trend is only getting started. It goes beyond creating computers with intelligent algorithms that can defeat chess grandmasters.

AI can change how we live and operate. It will be happening much sooner than you imagine. I will demonstrate how you can profit from it as an investor.

Artificial intelligence can unlock explosive value

As our Dear readers know, artificial intelligence is one of the five investment areas we're tracking for 2022:

- AI is in vogue. It is being utilized in various fields that range from media and finance to agriculture, healthcare retail, legal oil and gas, and even manufacturing.

- The sheer number of companies that range from startups to major players in the industry - that is, developing AI is astounding. The top players include Apple, Amazon, Google (Alphabet), IBM, Intel, Microsoft, Nvidia, and Meta (formerly Facebook).

It's all due to the enormous advancements in computing power nowadays. The power of computers is growing by about every 18-24 months, following Moore's Law, while the cost of computers is slashed by half.

This is the reason we enjoy real-time navigation in cars via GPS and stream videos on our phones. It also means that computer technology is not slowing down; rather, it is accelerating.

This is great good news. Artificial intelligence relies on computers to process vast quantities of data. It must convert data into useful information in a short time.

Research has shown that the computing power required to develop key AI landmarks in the last couple of years has increased roughly 3.4 months. This represents an increase of 300,000—instances between the years 2012 to the year 2018. As with every technological advancement, there is a potential profit angle.

Investment is surging into artificial intelligence

Utilizing artificial intelligence to beat your favorite board games like Deep Blue did in 1997 is only one of the possible applications for this cutting-edge technology.

The amount of companies offering commercial AI applications is growing every day, and so does the investment in it. Why? It's simple. Humans have generated more data over the last few years than they have in the history of all recorded time. There are more than 79 trillion gigabytes in data generated globally in the present. The volume of data grew by a double from 2019 until 2021.

Because of the pandemic, most of the world's population studied and worked at home and enjoyed more online entertainment than at such other times.

This trend is not over by any means. The volume of data available globally is predicted to increase by more than double by 2025. Humans simply can not handle this vast amount of information.

Entering artificial intelligence into the equation can help companies process massive amounts of data, identify patterns, and address specific issues. Companies are already using AI in a wide range of fields. Marketing is among the sectors that benefit most from AI with the highest degree.

Think about how much information world-class marketers Meta and Google get from our searches and browsing activities and the amount they can stand to earn through being able to focus on better advertisements. Correspondingly, they can utilize better and more efficient data analysis.

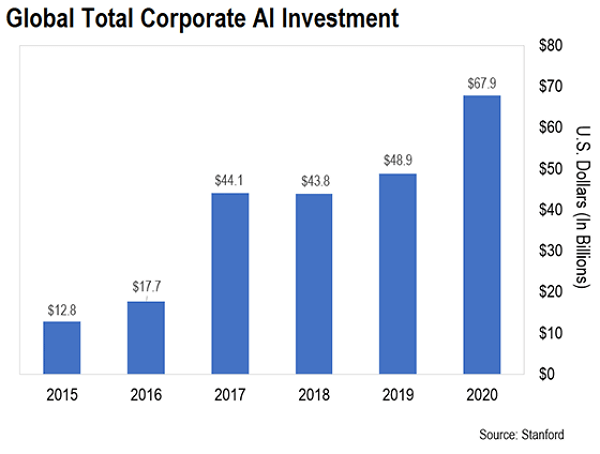

It's not surprising that there is an abundance of money going into AI. This is evident in the chart below:

The U.S. is the global leading private sector of AI investment; In 2020, American investment firms poured $23.6 billion in artificial intelligence. Investors in China invested around $10 billion in artificial intelligence. That makes China the second most popular market for AI research around the globe, following the U.S.

McKinsey's consulting firm estimates that artificial intelligence will be worth $5.8 trillion globally in 2022. This includes managing customer care, prices, and other business demands. Analysts estimate that AI will contribute at least $13 trillion to the world economy by the end of the decade.

Meanwhile, PricewaterhouseCoopers - a global professional services network - assesses that artificial intelligence will add about $15.7 trillion to the global economy by the end of the decade. (As a perspective, China's economy was valued at $14.7 trillion in 2020.

An easy way to be part of this trend

The bottom line. The artificial intelligence megatrend will transform many industries. It will also create the economic value of trillions of dollars. How do you, Dear reader, position yourself with this investment opportunity?

Many AI opportunities are only available to venture capitalists and insiders. They are not accessible to the typical investor. However, the Global X Robotics & Artificial Intelligence ETF (BOTZ) is an easy AI investment that you can open through an account with a brokerage firm.

BOTZ is home to around $2.6 billion in funds under its management. It also has 37 stock holdings, including the top chipmaker Nvidia. It provides you with exposure to companies involved in robotics and artificial intelligence development.

This article was printed from TradingSig.com